- MARKET OVERVIEW

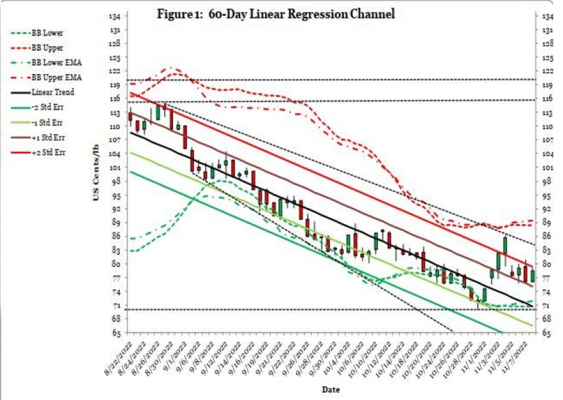

December cotton prices continued to rise for most of the week and were their highest close since mid-October, closing the weekend at 88.20 c/lb, up 182 points. Total opening interest contracts are more than 225 thousand. The trading volume was huge, averaging 63.5 thousand contracts in the last nine sessions.

Good news for the cotton market when US CPI data is released on 10th November, inflation for the whole year fell to 7.7%, lower than expected and compared with 8.2% in the previous month. Core CPI came in at 6.3% year-on-year, also below expectations and 6.6% a month ago.

The US dollar fell as CPI was announced and the stock market rallied. With inflation starting to trend lower, the 10-year yield fell 0.32% to 3.82%, which led to a sell-off in the US dollar and a major rally in the stock market. US stock. The Dow (up 3.7%) and the S&P500 (up 5.5%) are having their best results in two years.

Xinhua News Agency on 11th November reported that China eased the Covid-19 epidemic prevention regulations for foreigners entering China, who will only have to be isolated for 5 days instead of 7 days, in order to prevent Covid-19 under the new rules.

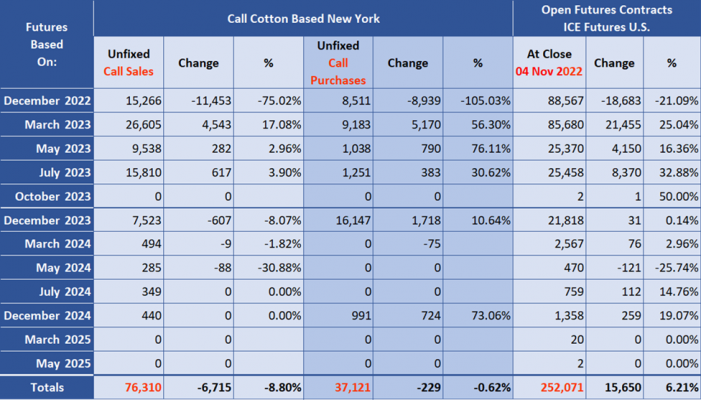

- SALES – EXPORT USDA REPORT

The US Export Sales report ended 03rd November showed modest but decent sales. Net sales reached 145,800 bales of Upland booked for the current crop. The largest buyer for the week in a row was China with 57,300 bales, followed by Pakistan with 40,500 bales and Vietnam with 23,4000 bales, with a total of 13 buying markets, while exports reached 111,500 bales delivered to 19 destinations.

- MARKET COMMENTS

The November Supply-Demand Report showed that mills’ cotton consumption globally fell only 2.4% from the previous season’s 117.4 million bales, but many mills in the main consuming market continued to mills have been running 20% or more below normal output since June, but if economic conditions don’t improve soon, the contraction in consumption will worsen.

With ICE December cotton now essentially liquidated, there is no reason for March futures prices to move higher at this point, as cash prices have barely followed the lead of the futures market, and demand is still declining. A weaker dollar could extend the futures rally for a few more sessions, but without an improvement in demand, it’s hard for the market to keep positive momentum.

The trend forecast on the chart is below the market at 77.76 – 77.86 and above the market at 115.73-115.81.

Thank you for your interest in the information.