The two cotton-producing countries in South Hemisphere, Brazil, and Australia become the big winner in the 2021/22 season. First, under favorable weather conditions, Brazil and Australia have bumper crops, while as the largest cotton exporter, the United States suffered severe drought, resulting in large production reductions and impacts on cotton quality. Meanwhile, cotton transportation was guaranteed with lower sea freight and eased port transportation. Currently, under the background of sluggish demand, 2022/23 cotton sales are dull in North Hemisphere and the expectation for the cotton production next season is not optimistic. But in South Hemisphere, in 2022/23 cotton production is still expected to be high and export volumes may keep increasing. Brazilian and Australian cotton may bring challenges to U.S. cotton.

1. High Brazilian and Australian cotton exports, but ordinary U.S. cotton exports

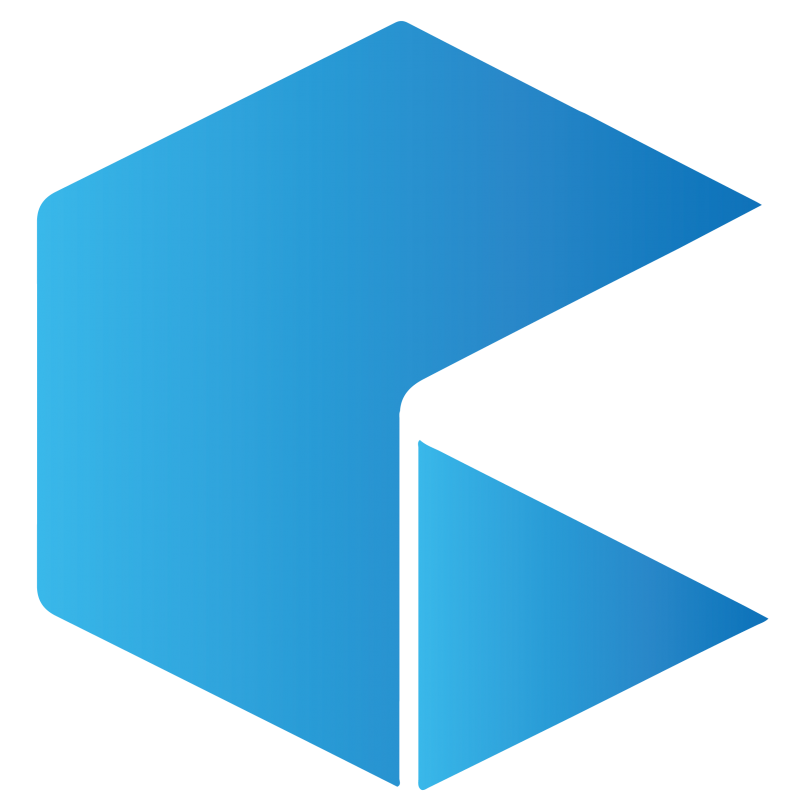

Since the 2022/23 season (from Aug 2022), monthly export volumes of Brazilian and Australian cotton were extraordinarily high. In Aug and Sep, Australian cotton exports reached 248kt and 215kt respectively, up 125% and 71% year on year, and the data in Aug hit a historical high. The largest buyer was Vietnam, and about half of the cotton was exported to Vietnam. Due to the lack of a Chinese market, offers of Australian cotton were lower than U.S. cotton previously, similar to the offers of Brazilian cotton. Not only good cotton production, but Australian cotton quality was also excellent, attracting buyers in Southeast Asia. For Brazilian cotton, despite the severe drought in Apr and May and the frost disaster in mid-May, cotton production is still expected to increase. Export volumes reached 185kt and 260kt in Aug and Sep, up 32% and 28% year on year. According to ABRAPA’s Oct report, 2021/22 Brazilian cotton exports are forecast up to 1.845 million tons, an increase of 445kt or 32% year on year. However, U.S. cotton export growth was limited. In the 2022/23 season, exports totaled 634.5kt from Aug to Nov 3, up 29% year on year. The export growth of Brazilian and Australian cotton was higher than U.S. cotton, indicating that they have seized some market shares of U.S. cotton.

2. 2022/23 cotton production remains optimistic in South Hemisphere

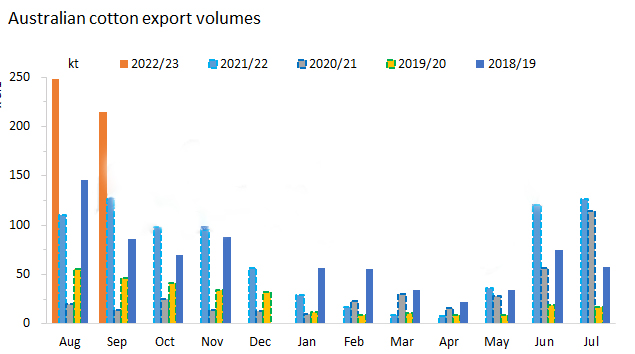

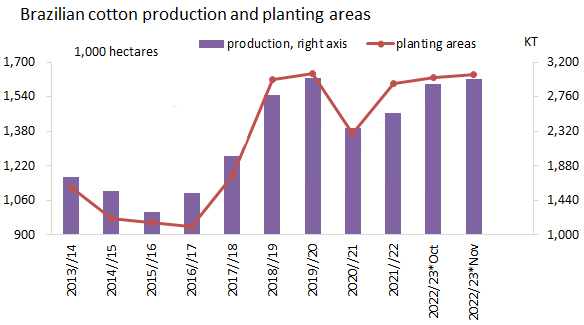

Though 2021/22 Brazilian cotton production increase is lower than anticipation, down from 2.78 million tons to 2.55 million tons, benefited from the sales at high level, cotton growers gain good profits and planting costs reduce obviously in recent months, so they are still active to plant cotton crops. Therefore, 2022/23 Brazilian cotton production is still expected to increase. In CONAB’s Nov report, 2022/23 Brazilian cotton production is forecast higher to 2.98 million tons, up 16.8% year on year, and ABRAPA forecasts up to 3.17 million tons, up 24.8% year on year.

Recently, heavy rain appears in cotton growing areas of Australia. Some low-lying regions in Queensland and Wales suffer floods, affecting the planting works of cotton crops. But the Cotton Australia stated that though the record cotton production might not appear again in the next season due to excessive rainfall, the total cotton production higher than average level was still confident.

3. U.S. cotton sales are poor, and new round of suppression is possible

The severe drought condition in the United States triggers the worries over U.S. cotton quality and prices have no enough discounts. Sales are not favorable overall. Except Pakistan and China, original large buyers like Vietnam turn to purchase Australian cotton. If U.S. cotton sales keep low, it may take certain measures to improve its competitiveness.