COTCO would like to send short market news as follows:

Cotton market this morning opened with a slight increase. Elsewhere, Chicago wheat, corn and soybean futures also rose.

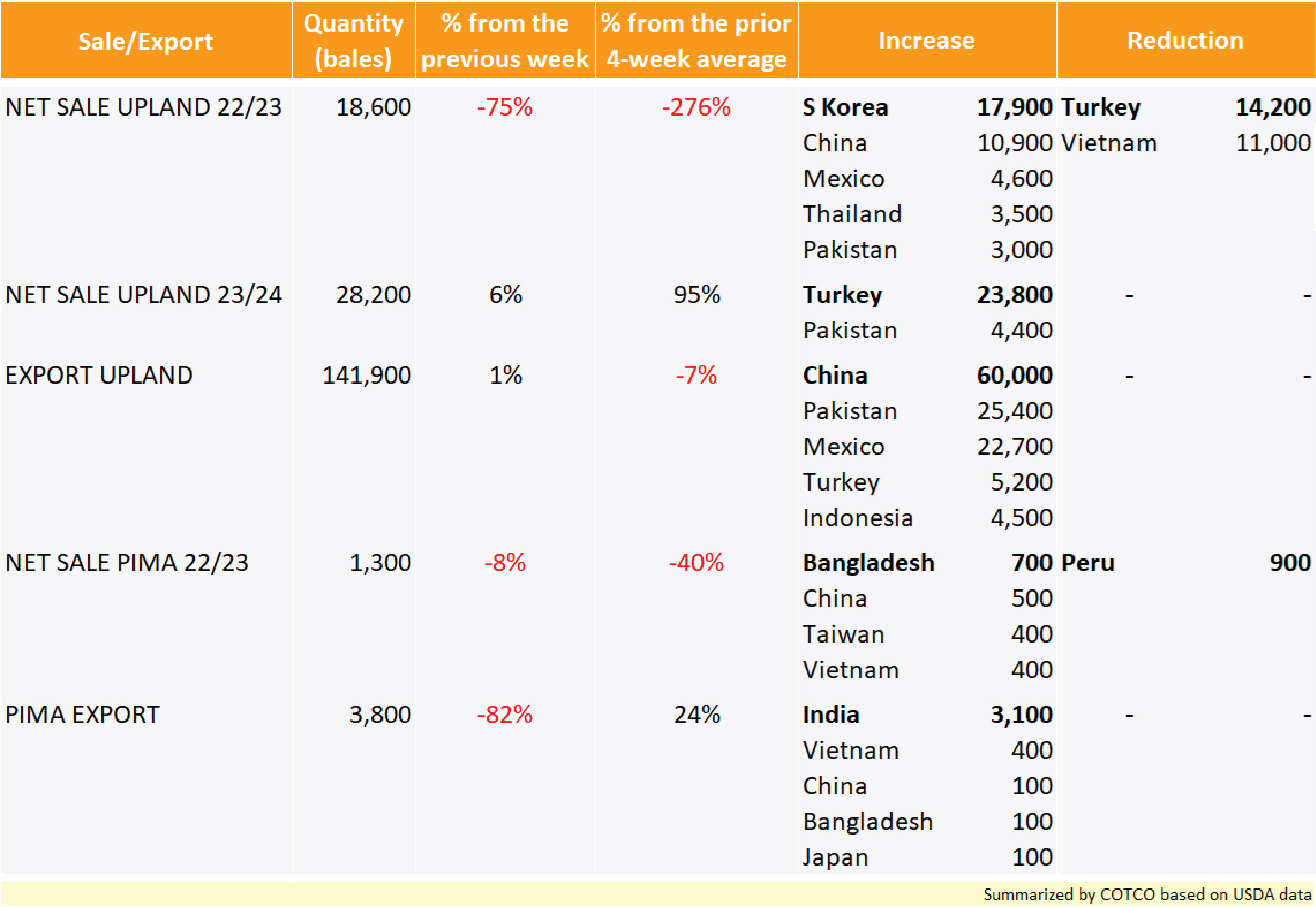

For the week ended 08th December, US cotton export sales for both UPLAND+PIMA were reported by USDA to be less than 20,000 bales; export shipments of nearly 146 thousand bales. New business is not strong and Mississippi River dries up further hampering deliveries.

US retail sales fell 0.6% in November and October, which does not bode well for holiday spending, especially given inflation.

Fed raised interest rates by half a point yesterday to 4.5%, but growth is expected to slow in the short to medium term. In EU, ECB raised interest rates to 2.5%.

Internationally, reports from spinning mills that despite falling cotton futures, retailers and brands continue to reduce orders.

The US Department of Agriculture in its December Supply-Demand WASDE Report last week lowered its global consumption forecast to 3.3 million bales, a decline in world cotton use of 4.9% year-on-year last.

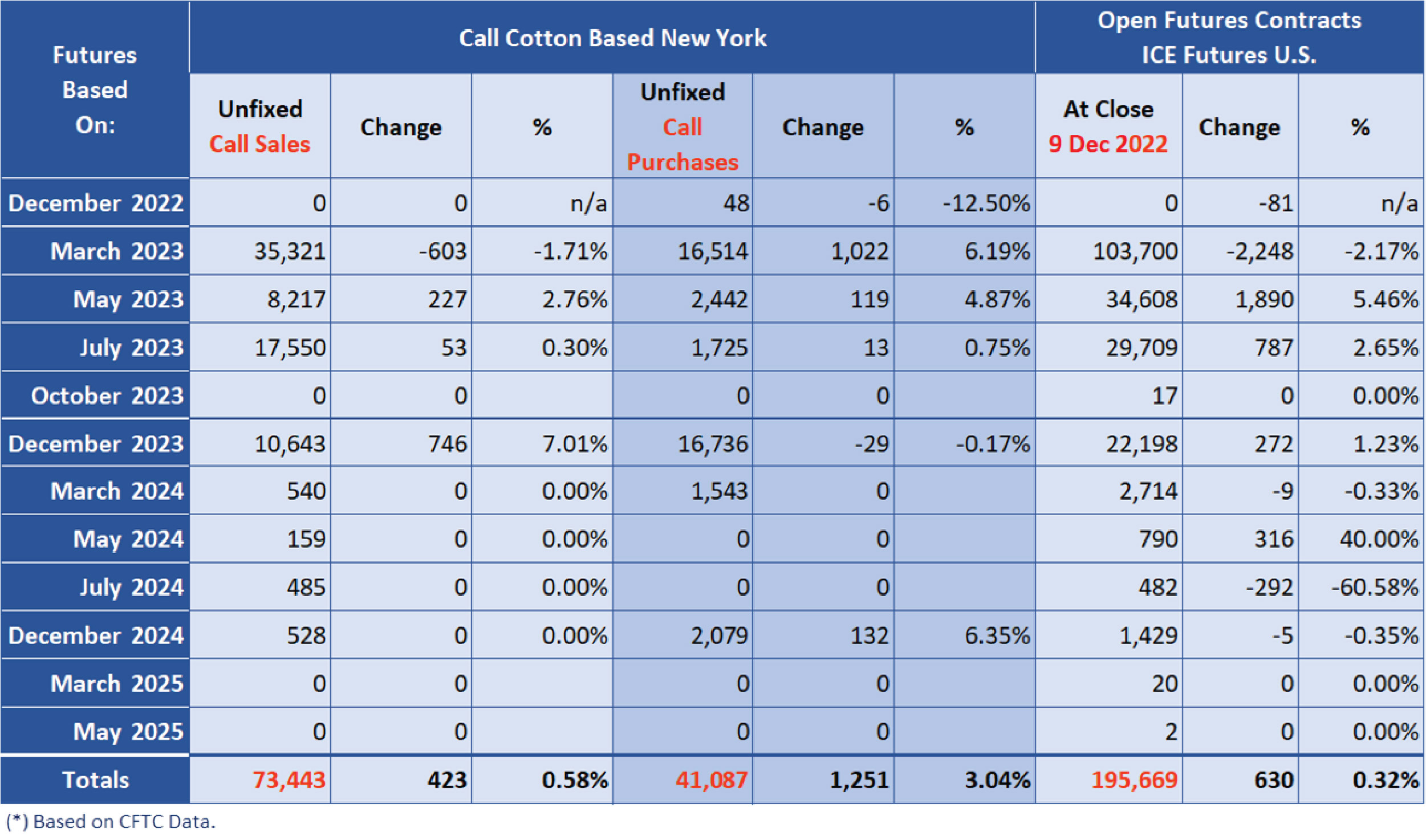

Investors are advised to buy and sell spot cotton within the current range (around 80 cents threshold) and invest in the bid spread on 23rd December or 24th March (short to medium term).

Estimated for a low chart at 72.28-76.19 (S2-S3) and a market high at 88.77-91.15 (R2-R3). Long-term bearish momentum was little changed yesterday.

The updated data report is as follows

Thank you for your interest in the information of COTCO NEWS