COTCO Company updates Sales – Export of US cotton this week with the following market news:

Cotton New York Futures gained more than 3% at the end of the week, this could be the biggest gain in 10 sessions, due to US’s lower crop, higher oil prices, and hopes of recovering demand from China against a stronger dollar.

The March cotton contract rose 3.10 cents, or 3.7%, to 85.68 cents a pound.

The dollar jumped after USDA data pointed to a strong jobs market, but with support from a falling US cotton crop, plus hopes that China will weather COVID in the near future. a short time and started buying cotton again helped the price of cotton to break out strongly.

For the week ending 29th December, USDA reported US cotton export sales of approximately 39,600 bales to UPLAND and 900 bales to PIMA; total export shipments only reached 97 thousand bales. Export figures are forecast to be lower in the January WASDE report.

Internationally, Brazil’s new crop production is estimated to be 13% higher than in 2022 at 13.3 million bales, but exports are expected to be 11% higher at 8.7 million bales. The increase in exports is expected to come from increased sales to China amid China’s boycott of Australian shipments and China’s frustration with the US for maintaining a ban on imports of related products. to the Xinjiang region.

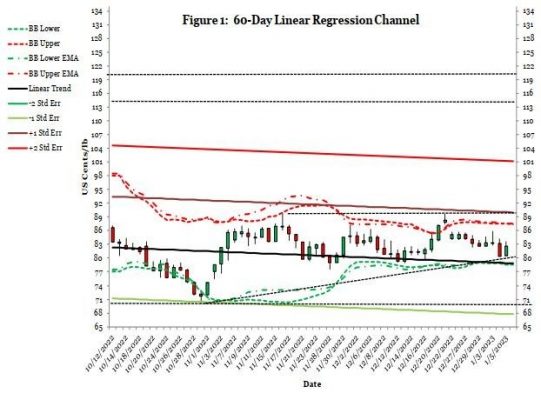

- Short-term expectations:

Markets are looking forward to reports on US and world economic data, mills’ on-call contract commitments, and impending index fund rebalancing ahead of the WASDE Supply and Demand report will be released on the first of the year on 12th January. In general, merchants and farmers are expecting the price to find support.

The forecast chart is low at 78.80 – 78.82 and high at 98.05 – 98.87.

The updated USDA figures report is as follows: